7th-Straight Mill Levy Reduction Being Proposed in Grand Island

Grand Island, Neb. —Grand Island Chief Financial Officer & Assistant City Administrator Patrick Brown will be presenting the proposed Fiscal Year 2026 budget to the City Council on Monday, September 8 at 6 p.m.

The budget includes a recommendation to once again lower the city’s mill levy—continuing a multi-year effort to keep property taxes flat for Grand Island residents. For the past seven years, the City has reduced the levy rate to offset growth in property valuations from the county.

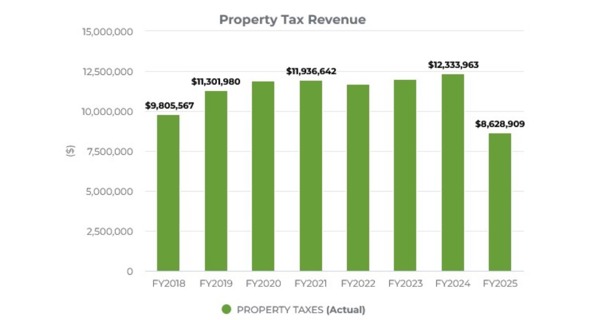

By doing so, the City has held its property tax collections steady at around $12.8 million since 2018, even as housing and property values rise. This approach has ensured that families and businesses in Grand Island are not burdened with rising property tax bills, allowing them to keep more of their hard-earned dollars.

“Grand Island has been intentional about controlling the property tax burden,” said Brown. “We’ve worked hard to make sacrifices in our budget and find efficiencies so that higher valuations don’t automatically translate into higher tax bills for our residents.”

While many Nebraska communities are experiencing steady increases in property tax revenue, Grand Island has distinguished itself by charting a different course. Neighboring cities such as Hastings and Kearney have seen property tax collections rise year after year, while Grand Island has prioritized stability and long-term taxpayer relief.

Per the Nebraska Department of Revenue, property tax collections by the City of Kearney have increased $1.56 million since 2017, while Hastings collections have increased by $1.58 million since 2019. Grand Island in that same time frame has maintained a zero percent increase in property tax collections.

“It’s important to us to show how a growing city can provide quality services without continually raising the property tax burden on its residents,” Grand Island Mayor Roger Steele said. “It takes discipline and teamwork, but it’s the right thing for our residents and will continue to be a priority of mine. This also doesn’t happen without CFO Patrick Brown keeping a watchful eye on our spending to make sure our residents get the best value for their money.”

The FY2026 budget will be presented at the City Council meeting on Monday, September 8, at 6 p.m. in the Council Chambers at City Hall. The public is encouraged to attend and participate in the discussion.

For more information, please contact Communications Manager Spencer Schubert at [email protected].

Special Meeting Agenda

Video interviews with Patrick Brown

Property Tax Collections

Proposed Budget